How early American inventors funded their ventures

by Jason Crawford · March 8, 2020 · 6 min read

I recently picked up a book that surveys major US inventions from ~1830s to WW1 (The Heroic Age of American Invention, by L. Sprague de Camp), and skimmed through the entire thing in one evening to find how each venture was funded. It’s an incomplete, informal survey, but here’s some of what I found:

Machines

Robert and Cyrus McCormick (father and son), who made an automatic reaping machine for farmers, self-funded out of their pre-existing farm and industrial concerns. Later, they formed a partnership with a man who had money from real estate. Another maker of farm equipment, Charles Newbold, self-funded his iron plow with $30k.

Samuel Colt designed and manufactured guns that bore his name. His early experiments were financed by his father; later, he made money by performing a traveling show using the recently-discovered phenomenon of nitrous oxide, also known as laughing gas. (!) He even tried smuggling, but he “was caught and lost heavily on the venture.” (!!) Later, he went the more traditional route of forming a company and getting investors.

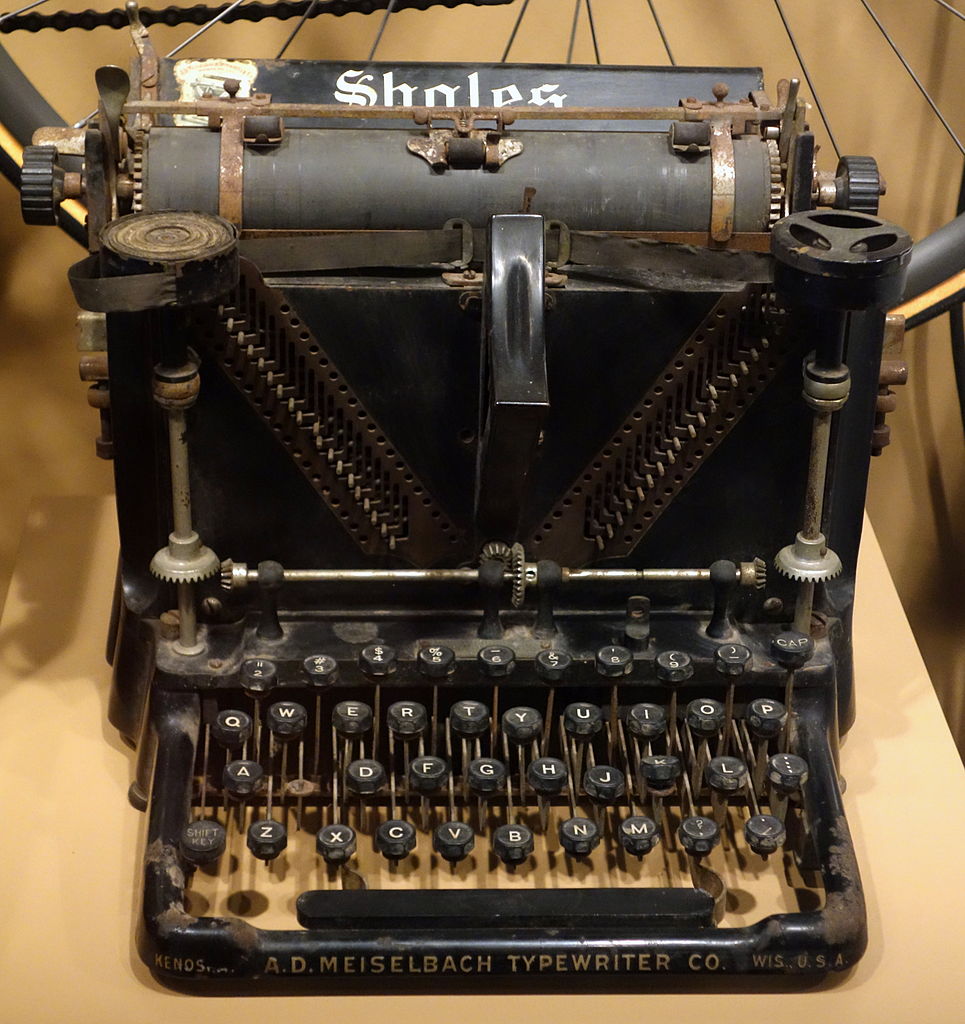

Christopher Sholes, who invented a typewriter, had a sinecure as customs collector, which gave him free time to tinker (not unlike Karl von Drais, who invented the earliest prototype of the bicycle). Later he took on a partner who paid for development costs. When the machine was perfected, rather than establishing production themselves, they sold the rights to the Remington company to manufacture it—similar to the way some pharmaceutical startups sell their IP to a larger company once it’s proven.

Materials

Charles Goodyear invented a process to treat rubber, known as “vulcanization”. Raw, natural rubber froze in the cold of European winters, becoming brittle, and melted in the summers, becoming sticky. Vulcanized rubber withstood a wider range of temperatures, making it practical for use in the temperate climates of Europe. Goodyear was famously obsessed with rubber, and pursued his experiments for years despite financial hardship for himself and his family. He borrowed from relatives at times and even sold his children’s schoolbooks at one point, and still he was in and out of debtor’s jail. He finally made money after perfecting the vulcanization process and patenting it.

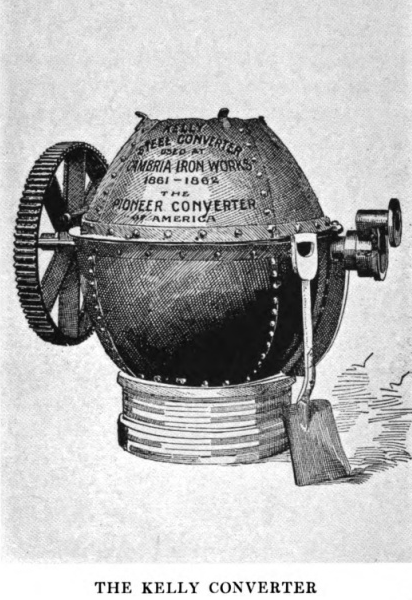

William Kelly, who independently invented the Bessemer process for iron refining, was already in the iron business when he started those experiments. Originally part of a family business, he sold his share in that company and borrowed more money from his father-in-law to set up his own iron works. Many people around Kelly thought his experiments were crazy, and his father-in-law wanted his money back if Kelly didn’t stop them; Kelly responded by continuing the experiments in secret at another location a few miles away. Later, once he had proved his new method, he set up a new company with some financial backers.

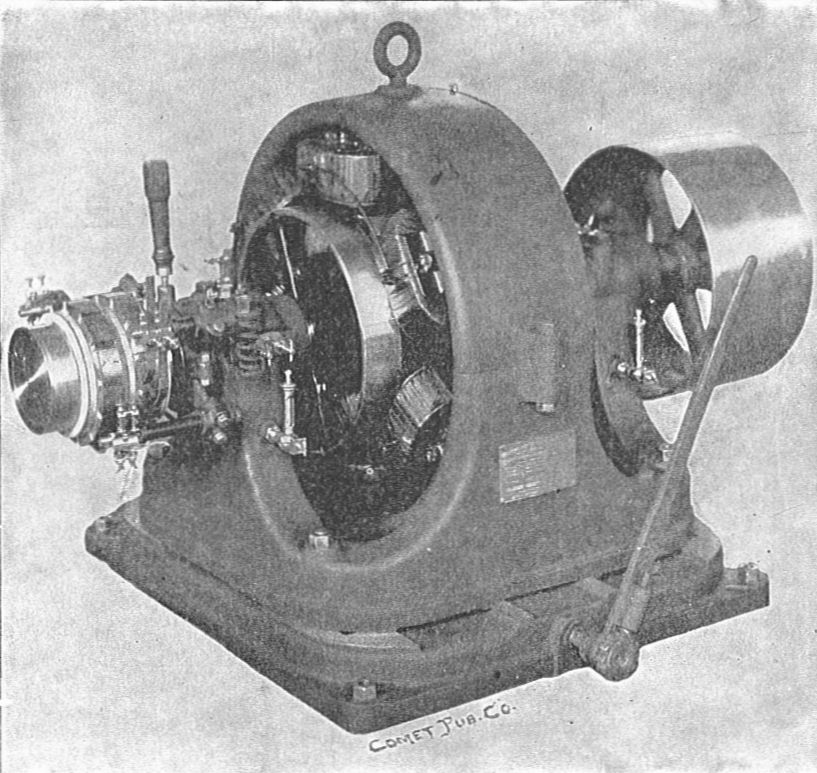

Electric power

George Westinghouse is best known as the pioneer of the AC electric power system. His first invention, though, was the “re-railer”, a device to help get derailed cars back on the track; he raised $10k from two businessmen to finance it. Later, he invented an improved brake for trains based on compressed air; this was financed by another angel investor. His later ventures, including in electricity, were self-financed based on the profits from the earlier ones.

Thomas Edison, whose mechanical genius was evident to those around him early on, became what the book describes as a “free-lance inventor” early in his career, backed by “several local people” who presumably knew him. He made improvements to the telegraph and ticker-tape machine and sold patents to Western Union; with this money he was able to open his own lab. When he hit on his biggest, career-defining invention, the light bulb, he received more backing from a syndicate of investors, including railroad titan Cornelius Vanderbilt. After the light bulb, he self-financed further ventures out of his own fortune.

Nikola Tesla made money inventing for both Edison and Westinghouse, and later had a lab backed by wealthy men including J. P. Morgan and John Jacob Astor.

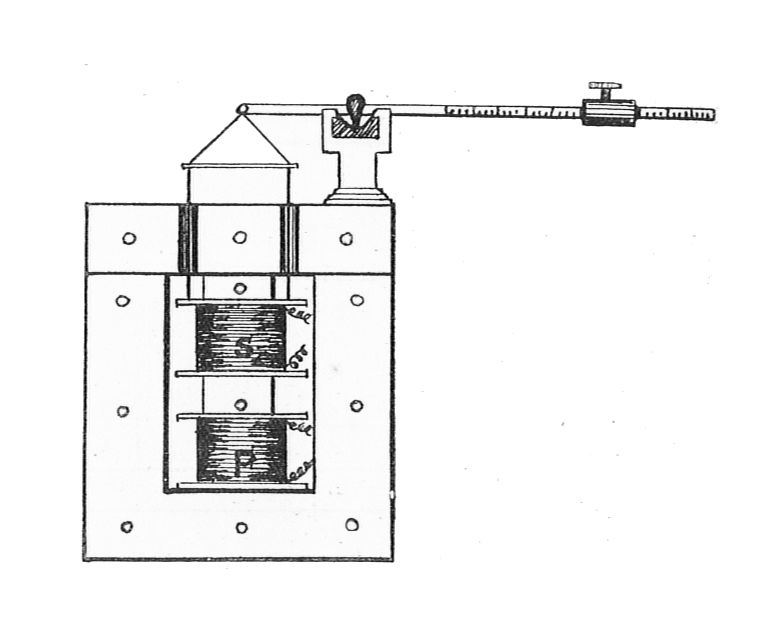

Elihu Thompson, who invented a type of electrical transformer, was a teacher. The book is not clear, but it seems that experimenting and tinkering may have part of the job; if not, then Thompson did it on his own time. His electric company was funded by “a group of capitalists”; when the company later merged with Edison Electric, Thompson used the money to fund further experiments.

Communications

Samuel Morse, telegraph pioneer, was a tutor/teacher and got money from the father of one of his students, who owned an iron works. In 1842, he got a $30k subsidy from Congress; similarly, in the 1850s, the trans-Atlantic telegraph cable was subsidized by the US and UK governments. Equity in the telegraph company was given to the owners of the huge ship that held the cable and made the crossing.

Alexander Graham Bell, like Morse, was a tutor who got money from the parents of his students. In Bell’s case, the backers were a lawyer and a leather merchant. Bell had two ideas: one was a variation of the telegraph designed to transmit music instead of text [correction: designed to send several messages at a time on one wire, known as a “musical” or “harmonic” telegraph]; the other, of course, was the telephone. The irony was that of the two, his backers wanted him to work on the “musical” (multi-message) telegraph. He placated them by working on both. These angel investors helped with more than just their initial cash: one helped Bell organize a company and promote his invention at the 1876 World’s Fair; the other pulled in his wealthy relatives to fund the company at a critical time.

Guglielmo Marconi invented the first radio technology, known as the wireless telegraph (because this first version was only good for transmitting signals, not voice or music). His wealthy father paid for his early experiments, and he later got the backing of some British investors. Fessenden, who invented AM radio, got backing from a banker and a soap maker.

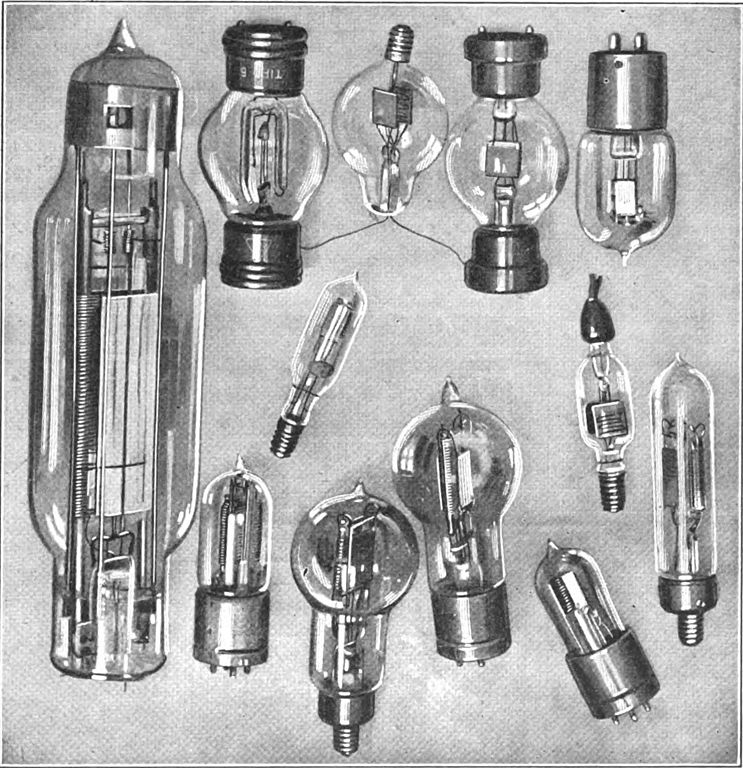

Lee de Forest, who invented the vacuum-tube amplifier or “audion”, worked nights as a teacher and invented during the day; he eventually organized a company.

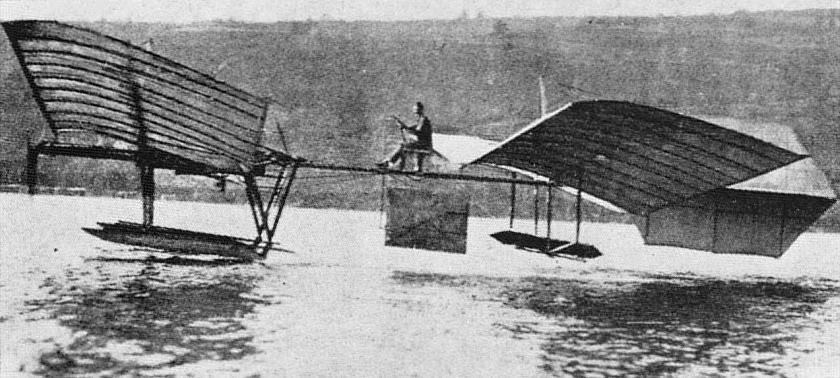

Flight

Samuel Langley, a predecessor of the Wrights, was a professor like Elihu Thompson, and did some invention in that capacity. He also apparently worked a lot of overtime, and never married. He got $70k from the War Department (which is what we used to call the Defense Department) and from the Smithsonian in order to work on an airplane. Congress, however, forbade further army funding for this project.

The Wright brothers themselves self-funded from the profits of their bicycle shop. After inventing their airplane and securing an order from Teddy Roosevelt, who gave them $25k, they were able to set up a company with the backing of some investors.

Summary

Many of these inventors relied on friends and family, or other angel investors they knew or had access to. In a remarkable coincidence, two of the early telecom pioneers, Morse and Bell, both got angel investment from the parents of students they tutored.

Many others self-funded, one way or another. Some had profits from existing or prior businesses, or from selling prior inventions. Others had jobs that gave them time to invent—either because invention was considered part of the job (as it may have been with Langley and Thompson), or because the job was simply undemanding (as with Sholes). Those who were not so lucky had to work nights (de Forest), launch creative side hustles (Colt), or suffer hardship (Goodyear).

Government subsidies and pre-orders were important for some infrastructure projects (telegraph) and for technologies with military applications (airplane).

In any case, once an invention or business had progressed to certain key milestones, such as a patent or even early sales, it was common to organize a company and get financial backers—typically, it seems, a syndicate of capitalists. My impression is that usually these were wealthy men investing on their own account—that is, what today would be called angel investors, as opposed to venture capitalists or other “institutional” investors who raise funds and invest other people’s money. Investment bankers, such as J. P. Morgan, would underwrite IPOs, and maybe they would invest earlier than that? I’m not sure.

What there doesn’t seem to have been, at least in what I’ve seen so far, is any kind of structure around early-stage financing. I haven’t seen any formal networks of angel investors, and nothing comparable to venture capital. Funding seems very ad hoc, dependent on the circumstance and connections. If so, then the rise of institutional early-stage funding in the mid-20th century was a real revolution.

(Note again that this is an informal survey from a single source, and I haven’t gone deeper yet to get the full details on any of these stories.)

Relevant books

The Heroic Age of American Invention